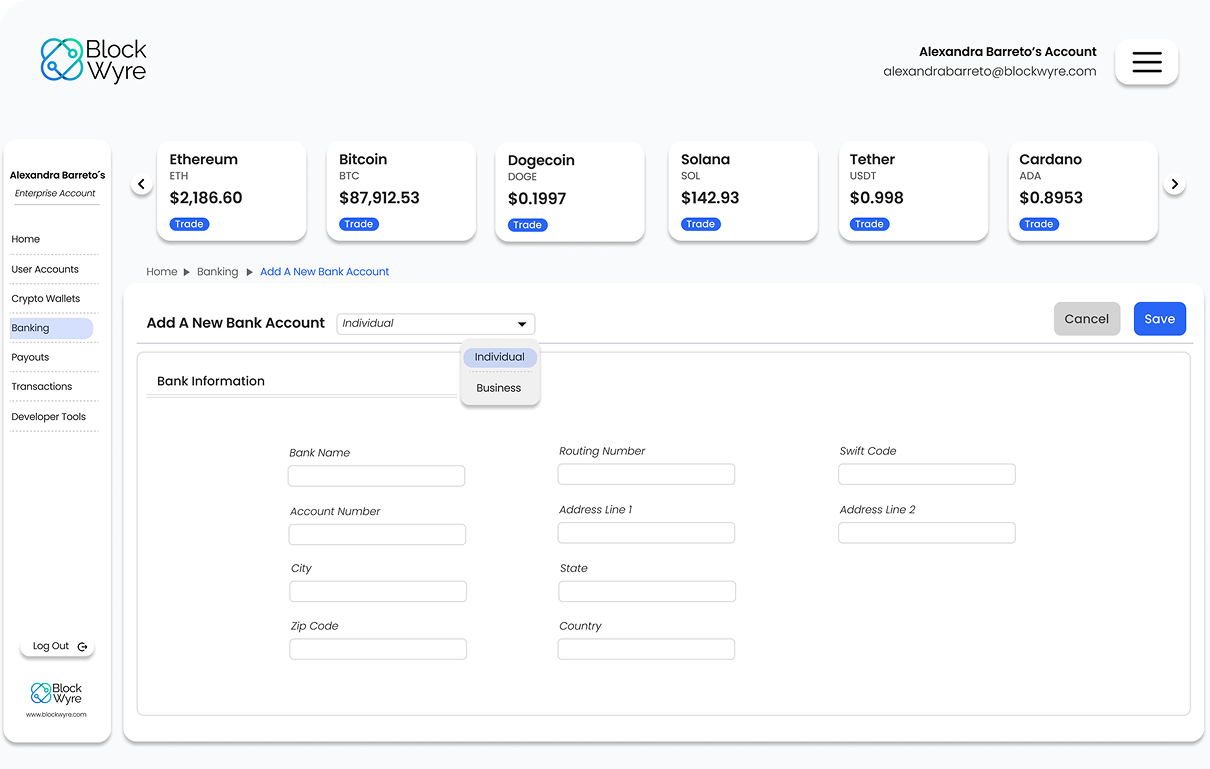

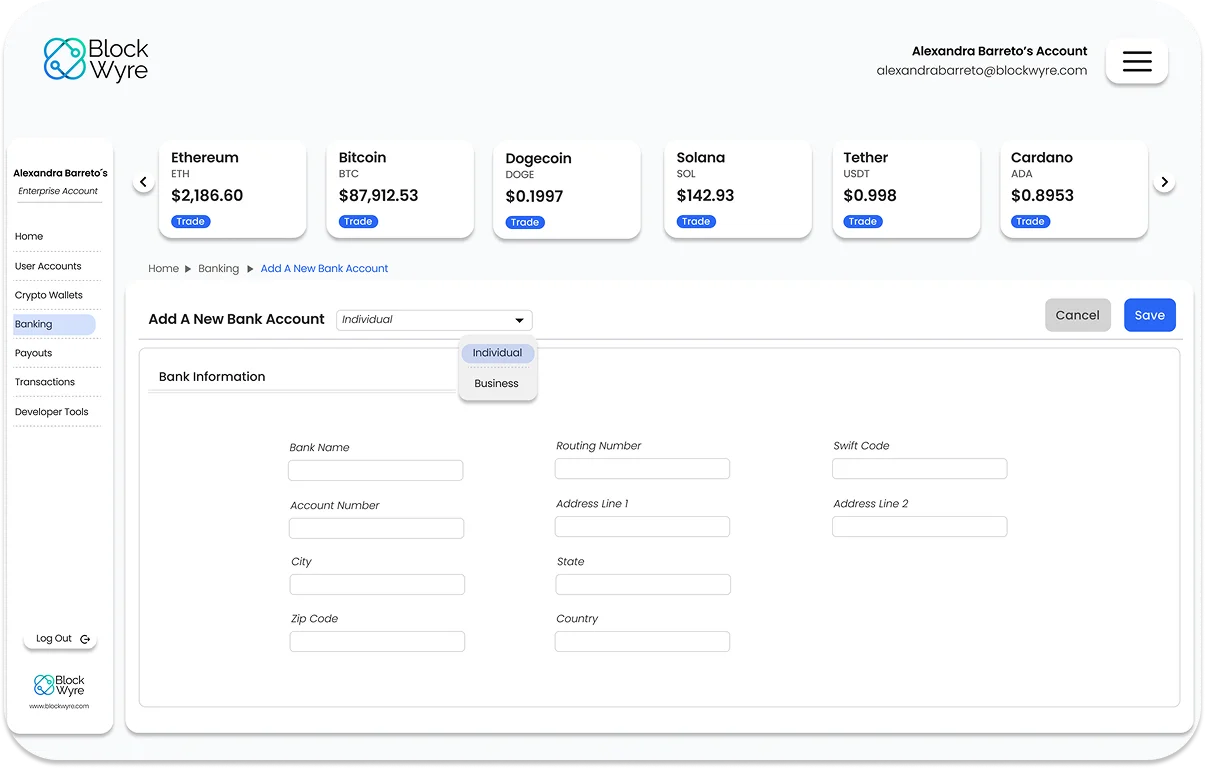

Banking and Accounts for Global Businesses

Open US dollar bank accounts for your business and users. Send and receive funds via ACH, domestic US wires, and international SWIFT. Orchestrate beneficiary pay-ins and pay-outs—through a crypto‑friendly, developer‑ready platform.

The Pillars of Next-Gen Banking: Trust, Velocity, Control

We remove the friction of legacy systems, offering a financial platform designed for rapid onboarding and seamless integration.