BlockWyre Agent Referral Program

Refer high-growth clients for virtual banking, USD accounts, payments, and digital asset wallets—backed by payout compliance tools and fast onboarding.

Trusted infrastructure, enterprise-grade compliance, and scalable APIs

An All-in-One Referral Program for Modern Finance

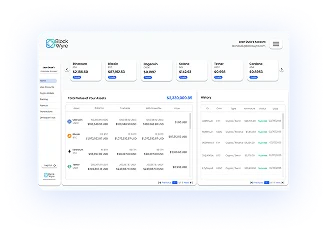

BlockWyre empowers agents and partners to refer clients to a unified banking and payments platform built for today’s fintech ecosystem. Your referred clients gain access to virtual banking, US dollar accounts for global teams, domestic banking rails, multi-currency payment flows, secure digital asset wallets and custody, and beneficiary pay-ins with payout compliance tooling. With fast onboarding, flexible credit policies, and competitive fees, you’ll offer a powerful solution while earning daily commissions and managing submissions through a dedicated agent portal.

What Your Clients Get with BlockWyre

Virtual Banking & USD Accounts.

Provide US dollar bank accounts for global clients, alongside domestic rails and multi-currency support to simplify treasury and settlement.

Learn morePayments & Beneficiary Pay-Ins.

Accept and route pay-ins across regions with transparent sub-ledgering and real-time reconciliation.

Learn morePayout Compliance Tools.

Build compliant payout flows with KYC/KYB, AML screening, monitoring, and beneficiary verification.

Learn more

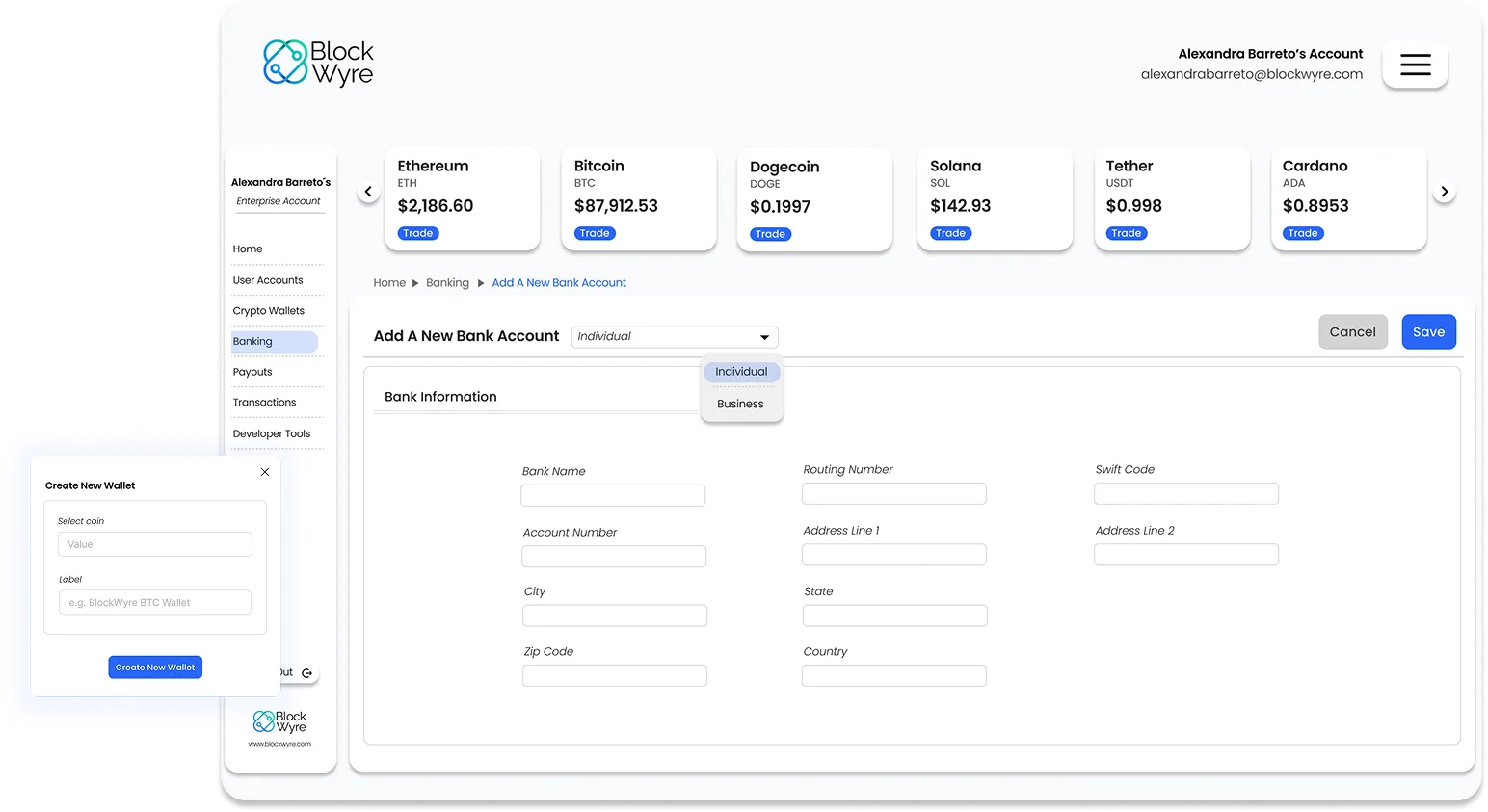

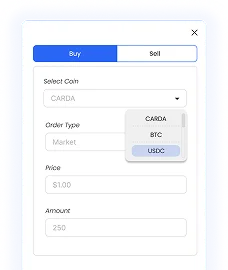

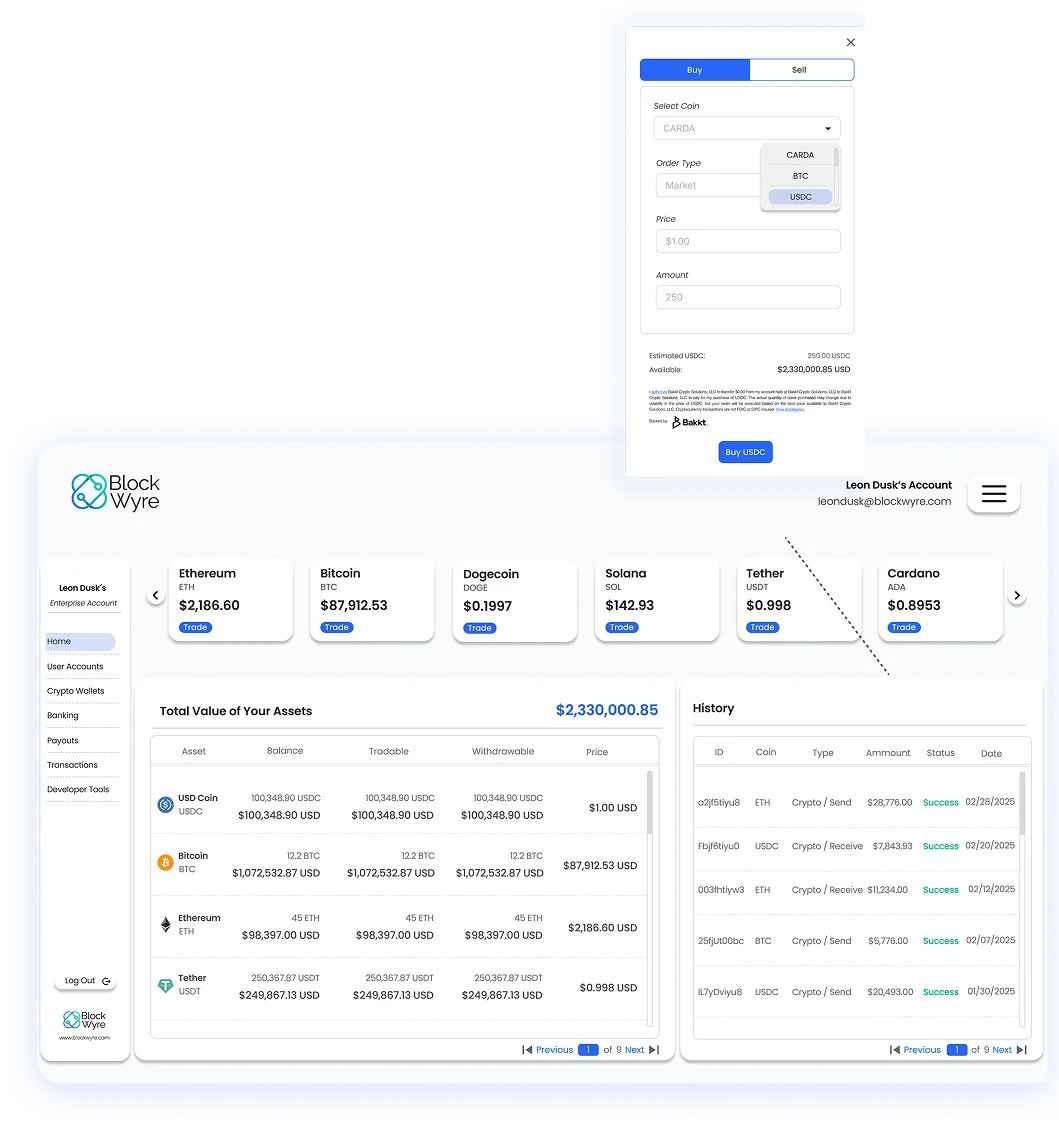

Digital Asset Wallets & Custody.

Offer secure digital asset wallets, custody, and trading access — integrated with fiat accounts and payment rails.

Learn more

Fast Onboarding & Flexible Credit.

Move quickly from application to production with pragmatic risk controls and flexible credit policies.

Learn moreCompetitive Fees, Built for Scale.

Transparent, competitive pricing designed for payments volume, cross-border growth, and digital assets.

Learn moreUse Cases We Support

How the Agent Program Works

Apply & Get Approved:

Submit your agent application and complete KYC/KYB.

Access the Agent Portal:

Submit client referrals and track statuses in real time.

Client Onboarding:

Our team handles onboarding, banking, wallets, and compliance setup.

Earn Daily Commissions:

Get paid daily with transparent reporting and trade execution support.

Benefits for Referral Partners

Unlock recurring revenue with a program built to scale. Provide your clients with compliant, crypto-friendly banking, payments, and custody—while managing deals from one portal and receiving daily commission payouts.

Back-office agent portal for submissions and tracking.

Access to bank accounts and digital asset wallets.

Daily commission payouts.

Trade execution support.

Comprehensive client reporting.

Competitive commissions, strong product offering.

All-in-one solution that boosts close rates.

Dedicated partner success support.

Compliance, Coverage, and Controls

BlockWyre emphasizes compliance-first operations across banking and digital assets. Your clients benefit from KYC/KYB onboarding, AML screening and monitoring, payout compliance tooling, and audit-ready reporting. With multi-currency support and US dollar accounts for global teams, BlockWyre helps accelerate international expansion while maintaining robust governance over pay-ins, payouts, and digital asset activity.

Global coverage with USD and 30+ currencies (as applicable)

KYC/KYB and AML monitoring.

Payout compliance tooling.

Sub-ledgered accounts and reconciliation.

API-First, Built for Developers

Ship faster with modern APIs and SDKs for banking, payments, and wallets. Generate and monitor wallets, process secure transactions, and reconcile balances with sub-ledger transparency. Whether you’re extending a gateway, powering remittances, or launching digital asset features, BlockWyre streamlines integration.

What Our Partners Say

FAQs

What is the BlockWyre Agent Referral Program?

The program enables approved partners to refer clients who need virtual banking, US dollar accounts, payments, digital asset wallets, and payout compliance tools. Agents earn commissions on successful referrals and manage activity in a dedicated portal.

Who qualifies to become an agent?

Ideal agents include ISOs, fintech consultants, payment providers, gateways, BD professionals, and developers with relevant client networks in fintech, payments, remittances, e commerce, and digital assets.

What products can my clients access through BlockWyre?

Virtual banking and USD accounts, domestic banking, payments and beneficiary pay-ins, payout compliance tools, and digital asset wallets with custody and trading access.

How quickly can my referred clients onboard?

Onboarding speeds vary by jurisdiction and use case, but BlockWyre emphasizes fast onboarding with pragmatic risk controls and flexible credit policies.

How are commissions paid?

Agents receive daily commission payouts, with real-time reporting and tracking via the agent portal. Specific tiers and terms are provided during onboarding.

Is BlockWyre crypto-friendly and compliant?

Yes. BlockWyre supports blockchain and digital assets with a compliance-first approach, including KYC/KYB, AML monitoring, and payout compliance tooling.

Which geographies and currencies are supported?

Coverage is expanding and includes US dollar accounts for global clients and support for multi-currency balances. Contact us to confirm your target corridors.

How do I get started?

Apply to become an agent using the form, or book a discovery call. Our team will review your application and provide next steps.

Become a BlockWyre Agent

Help clients launch virtual banking, payments, and digital asset wallets—while you earn daily commissions.

We typically respond within 1–2 business days.